Bar Friday night’s spike, crude has enjoyed an uncharacteristically sedate ascent since the turn of the year. Brent is heading into the mid $80s, and WTI firmly in the high $70s. Despite the barrage of geopolitical risk headlines in the market, flat price has not been a runaway train. While product diffs have been hyper-sensitive to the headlines regarding activities around the Bab al-Mandab Strait, DFL and crude spreads have remained relatively low compared with recent history.

Routing adjustments in seaborne oil movements will mostly impact arbitrage economics rather than provide an overall supply shock. That said, the market is primed for a near term rally with spec positioning light in the product futures and momentum traders eager to chase values higher.

Light Ends

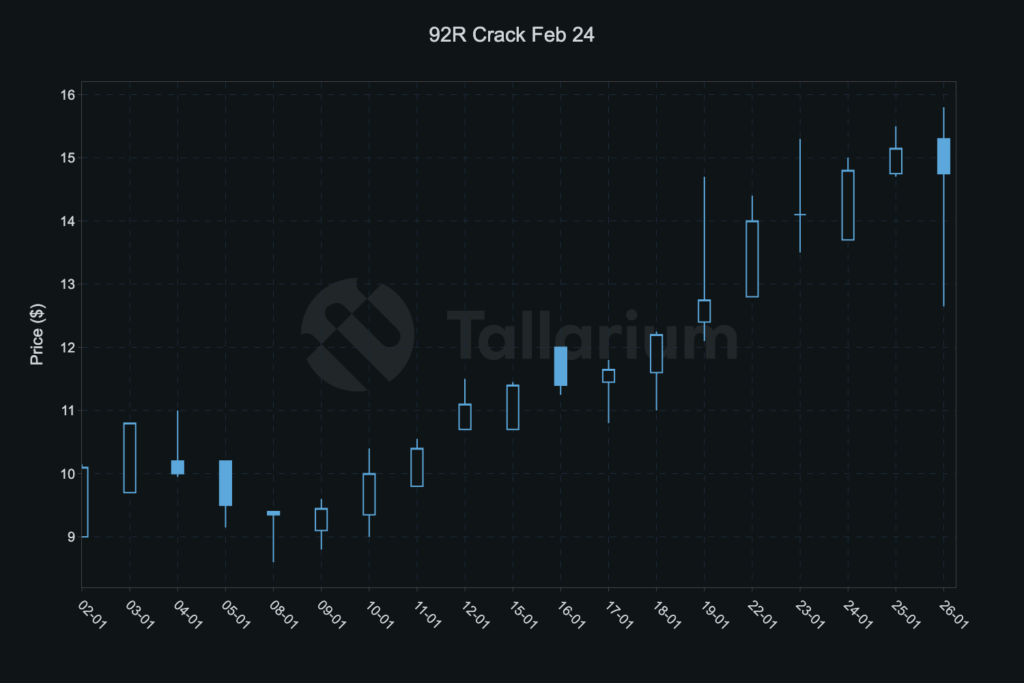

Prompt 92R spreads have had a stellar month, with Feb/Mar 92R rallying hyperbolically from $0.25/bbl on the 10th January up to $1.75/bbl now. The prompt 92R crack has rallied $6/bbl over the last fortnight making it the strongest product across the board. This has had a knock-on effect on other gasoline markets which have consequently been dragged higher. The Red Sea disruptions to the ordinary trade flows are without doubt the main catalyst, so we can perhaps expect these values to ease once a new normal is established.

Distillates

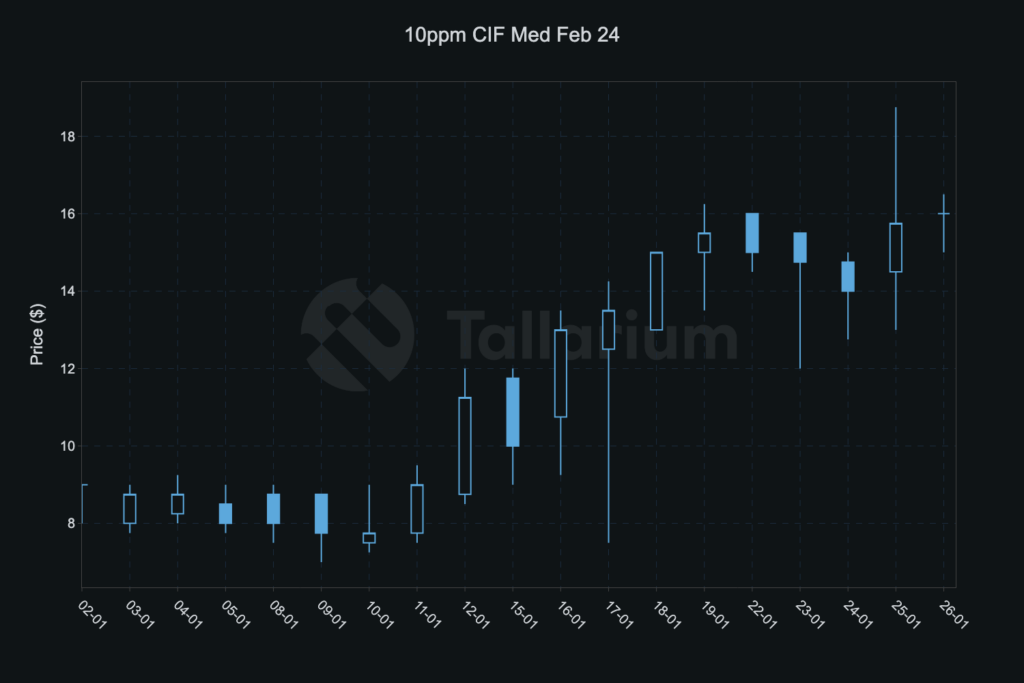

10ppm CIF Med jumped sharply since 12th Jan, with Feb trading as high as $17.50/MT. The Med diesel market is heavily dependent on seaborne re-supply so has responded most acutely to the prospect of delays in supplies which ordinarily take between 10-15 days to arrive via the Red Sea and Suez.

As always with oil markets there are alternative supply sources, so the market will need to remain at a level at which bbls can be sourced from USGC or ARA. Gasoil cracks and spreads have in turn rallied significantly to reflect this additional pull on the price centre. Meanwhile Gasoil East/West and Singapore time spreads have eased from the highs to allow more Asian Gasoil to economically make its way via Cape to Atlantic Basin markets.

Overall, the complex has rallied as price centres react to uncertainties in nearby re-supply, however this will normalise once the new trade flow is established, and the market acknowledges no loss in the available supply of molecules. In fact, the longer journey times may end up giving Europe an excess of re-supply in Feb as arrivals stack up. Jet values are also revealing. NWE Jet, which is ordinarily so dependent on re-supply through Red Sea and Suez, has dropped $10/mt from the initial spike.

While it’s very difficult to estimate the correct geopolitical risk premium warranted in flat price crude right now, the recent escalations have not dented fundamental product balances. However, the developments remain bullish for the overall complex as it can take weeks if not months for the new arb flows to establish. Gasoline, Naphtha and Distillates are currently hand to mouth markets with relatively low stocks worldwide.

The lack of redundancy in these markets makes them the most likely to react to nearby delays in re-supply. This combined with light positioning in the specs mean the rallies can become more severe in the event of further headlines and the market can run up some more. However, the medium-term risk is that values become over-inflated, and things correct very sharply later in Q1 when fundamentals play out.