Overview

Last month we noted the post-summer implosion of US gasoline markets and the risks it posed for the oil complex. This eventually manifested in a spectacular decline in WTI, as refiners shunning crude in the mid-continent translated to faster-than-forecast US crude builds.

Brent was not spared – as may have been the case in previous years – as the possibility to arbitrage US crude into the Brent screen has made these global crude benchmarks fundamentally more interconnected than at any time in recent history.

As November ends, Brent and WTI are considerably weaker contracts than they were at the start of the month, trading around $80/bbl and $75/bbl respectively. The time-spread weakness is more pronounced, with prompt WTI currently trading in contango (Jan/Feb is -23c/bbl) and Brent only slightly backward.

However, strength in Asian crude grades, particularly Murban, is tempering bearishness at these levels. Furthermore, a lot of the geopolitical risk premium has come out of the flat price, given the violence in the Middle East has not spread further afield in the way that some had anticipated. Crude traders’ eyes are now focused on the postponed OPEC+ meeting on November 30th, which was originally scheduled for last week.

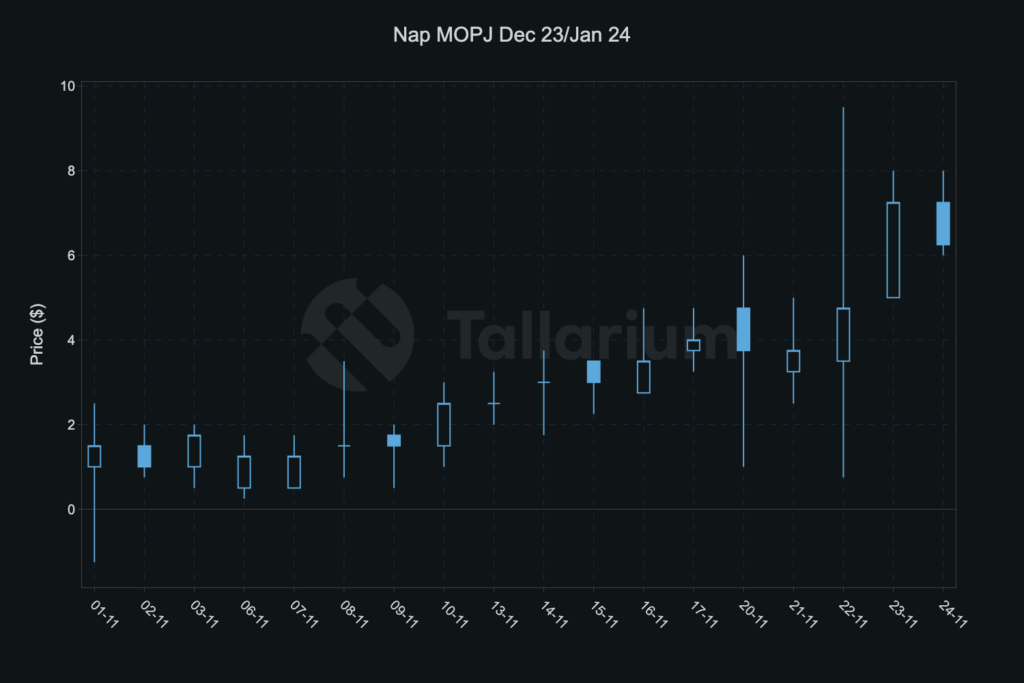

In clean products, there are signs of underlying fundamental strength in the market that should ensure the oil complex remains supported from these levels now into year-end no matter what the outcome of the OPEC+ discussions are. Gasoline has surprised with its stubborn push higher, Naphtha has bounced back from the dead, and Distillate markets suddenly look too cheap versus other fractions of the barrel.

Light ends

Gasoline rebounded handsomely from its mid-October lows. Dec/Jan Ebob has rallied from virtually flat to +$8.00/MT, while the Dec Ebob Crack has bounced $5/bbl from its lows. This is a big support for European margins and will ensure that refineries remain incentivised to run and produce light ends into the winter months. Naphtha has also enjoyed somewhat of a renaissance albeit from very low levels, with winter spreads in ARA now solidly backward, following a spike in the strength of Eastern Naphtha markets.

Distillates

Distillates had a relatively tepid month by their standards, with time structure overall weakening under the weight of the crude sell off and December cracks seesawing mainly between $26/bbl and $29/bbl. Light ends have outperformed in recent weeks, however as we have said all year stock levels are just too low for distillates to weaken meaningfully, particularly with winter on the horizon.

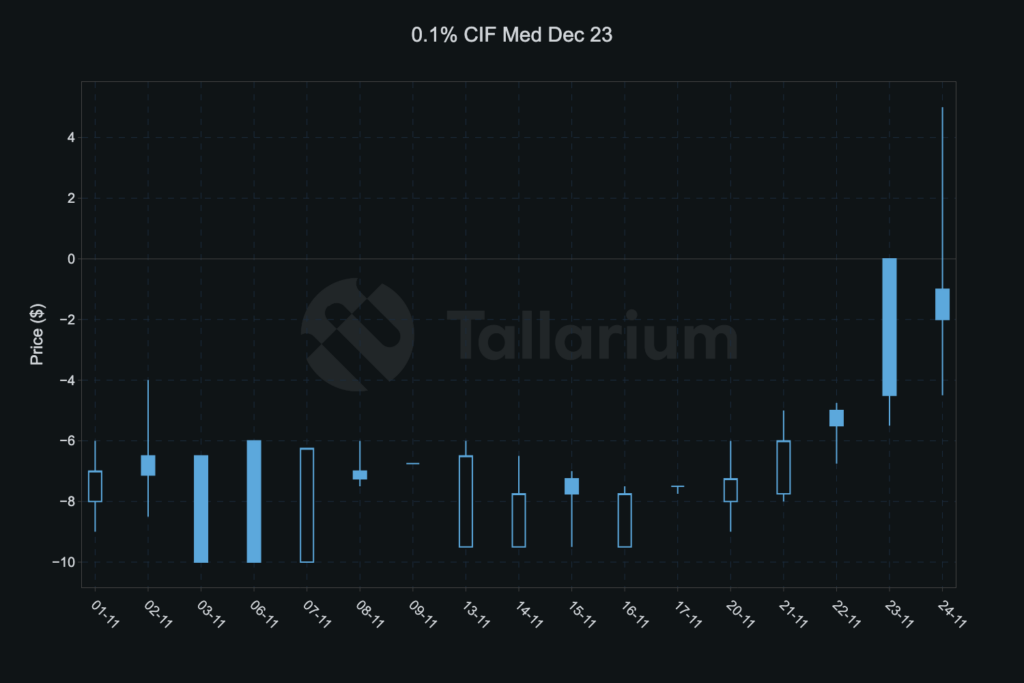

While ARA gasoil stocks have built a smidge, the strength in the NWE CIF markets should ensure the pricing centre receives only essential re-supply volume in December as inbound cargos have more profitable markets to go to. High sulphur gasoil, although increasingly illiquid on paper, is also an area to keep an eye on. We have seen an uptick in the buying interest for 0.1% Barges and 0.1% CIF Med, which will eventually be another support for diesel. Jet is also now trading over diesel in NWE and Singapore which will incentivise refiners to maximise Jet make, further reducing diesel supply over the next few months.