*Report reflects markets as of 18th March 2024

Overview

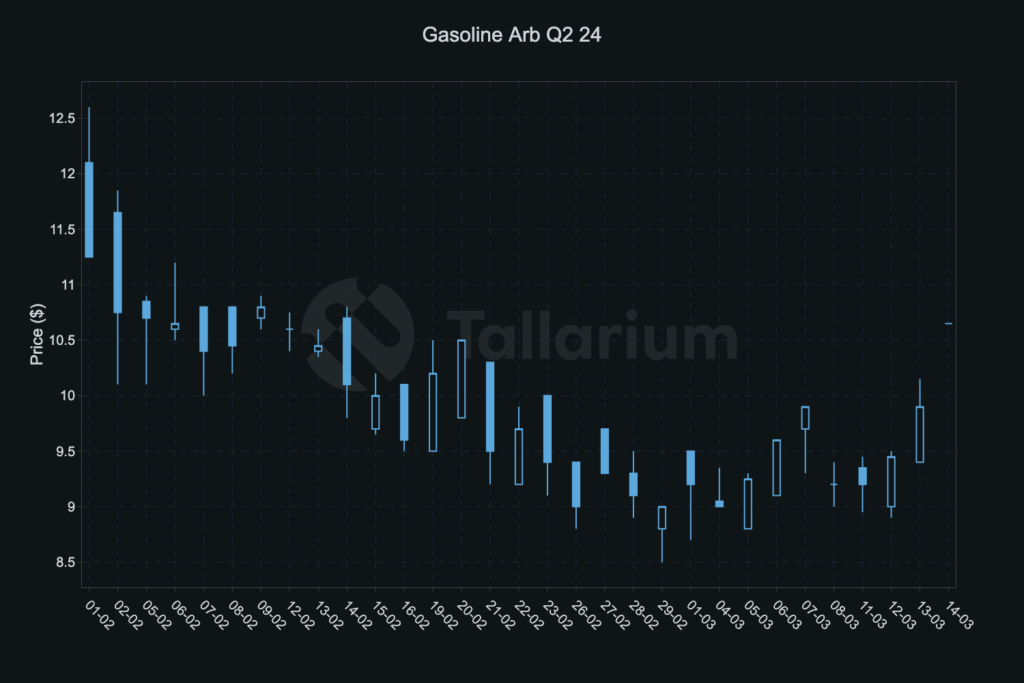

Crude flat price is showing signs of breaking out of its recent range, with Brent back above the $85/bbl mark for the first time since November last year. Ukraine’s recent drone strikes on refineries in Russia certainly spooked traders and are as likely a catalyst as any for the strength seen during the second half of last week. Gasoline and Naphtha meanwhile continue to move higher, making them the best performing cracks in the barrel. Petrochemical demand has evidently been robust and TC5 has surged, with April paper trading a high of WS 262 on 14th March. These factors will continue to support Naphtha, which together with Gasoline is arguably the most significant fundamental driver of strength in the oil complex right now.

All eyes will be on Gasoline performance as we enter Q2. While crude has been more sensitive to Distillates’ waxing and waning in recent years, this year Gasoline seems to be the fraction of the barrel with the most riding on it. Question marks remain over global oil demand growth this year, so US Gasoline demand this summer will be a metric high up on traders’ lists of items to track.

Distillates

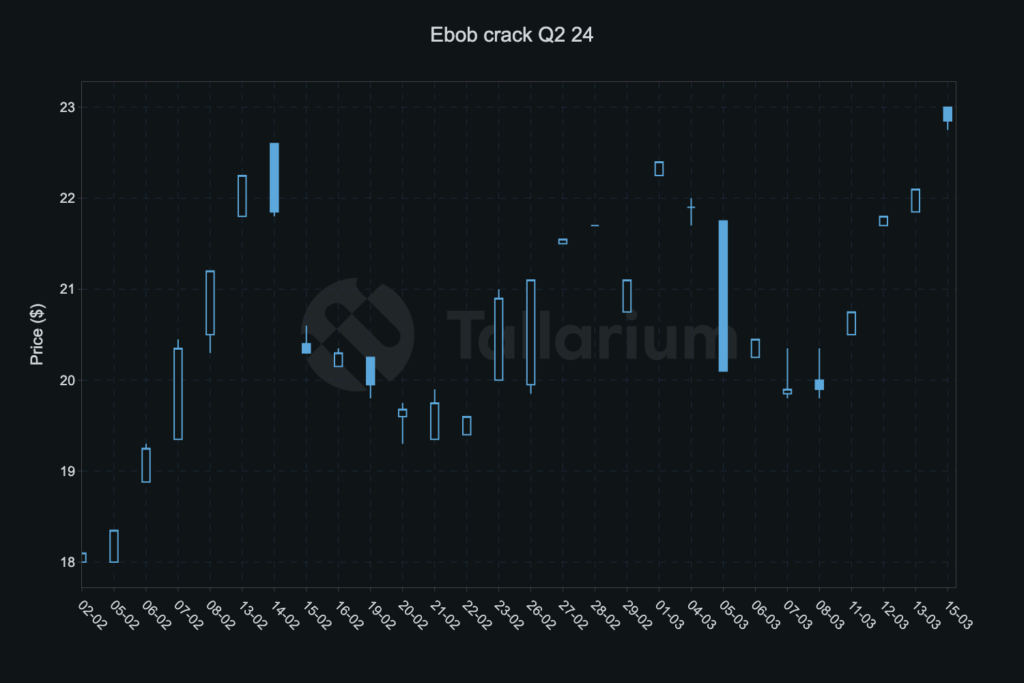

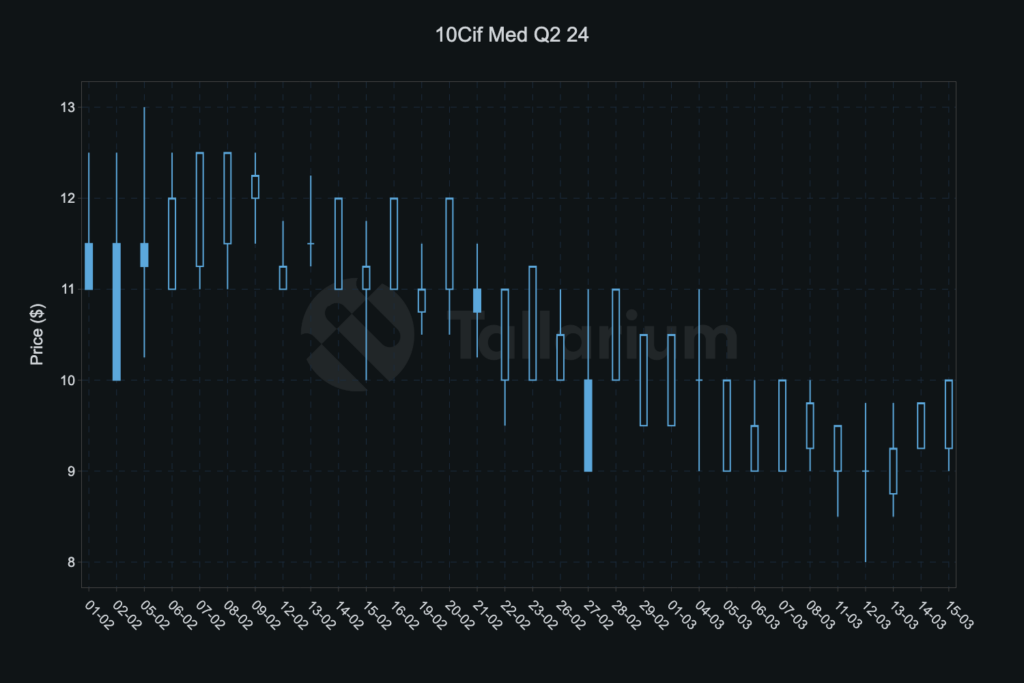

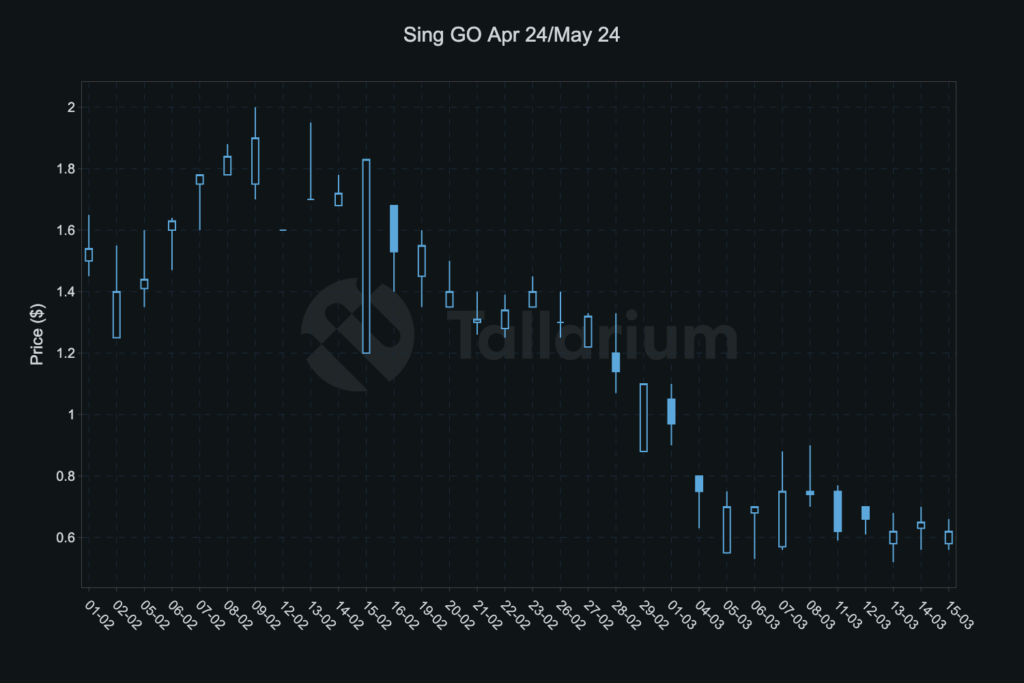

Weakness in Singapore Distillates has been enough to keep a lid on spreads and cracks on the New York and London exchanges. The Apr/May Sing Gasoil spread is trading around $0.60/bbl, which is $1.30/bbl lower than the peak traded value of $1.90/bbl on 9th February. Eastern values have shown they are able to drop to levels required to supply the tighter Atlantic Basin markets in Q2. This descent in Distillate values has been steady and orderly, and a painful one to have endured for the length of time in the market. A look at differentials in the Med show that Q2 is trading $9.50/MT, which is $2.50/MT below the peak in February. The market seems satisfied that there will be ample re-supply despite the disruptions in global shipping, particularly through the Red Sea.

Conclusion

Q1 has been relatively sedate for Crude flat price, and those with an eye to the macro will certainly have found more exciting markets to follow in recent months. Tech stocks and cryptocurrency price action has made these markets far more enticing for speculators.

This latest attempt by Crude to buck the trend across the wider commodity complex and break higher will only last if fundamentals can sustain as we enter Q2. Gasoline will likely need to continue its stellar performance for crude to continue this nascent rise.