Distillate markets have been the reliable, hard worker of the oil complex since the post-Covid slump in 2020. However, signs are emerging of sustained weakness across Distillate contracts globally. The prevailing “perma-backward” of recent years, the ICE Gasoil and NYMEX Heating Oil spread environment, is being challenged. On Brent’s latest push to and above $90/bbl this month, it’s important to keep this unravelling in mind. Traders need to delineate the causation of this move up in Crude, as this is happening in the context of very weak signs in Middle Distillates.

Crude itself is arguably tighter. Dubai spreads have been firm, pressuring Brent/Dubai into negative territory earlier this month. The recent exchanges between Iran and Israel and the continued situation in Gaza are resulting in traders assigning an increasing geopolitical risk premium in the underlying Crude price. It is difficult to argue against this risk premium being warranted, but it’s equally important to track the health of underlying product markets.

Despite record exports to the Atlantic Basin, Eastern Diesel and Jet Fuel markets seem to be settling into contango, which points towards potentially significant stock builds to come this summer. More Middle Distillate-centric refining capacity is coming online in Asia which will continue to keep Middle Distillate supplies healthy.

Light Ends

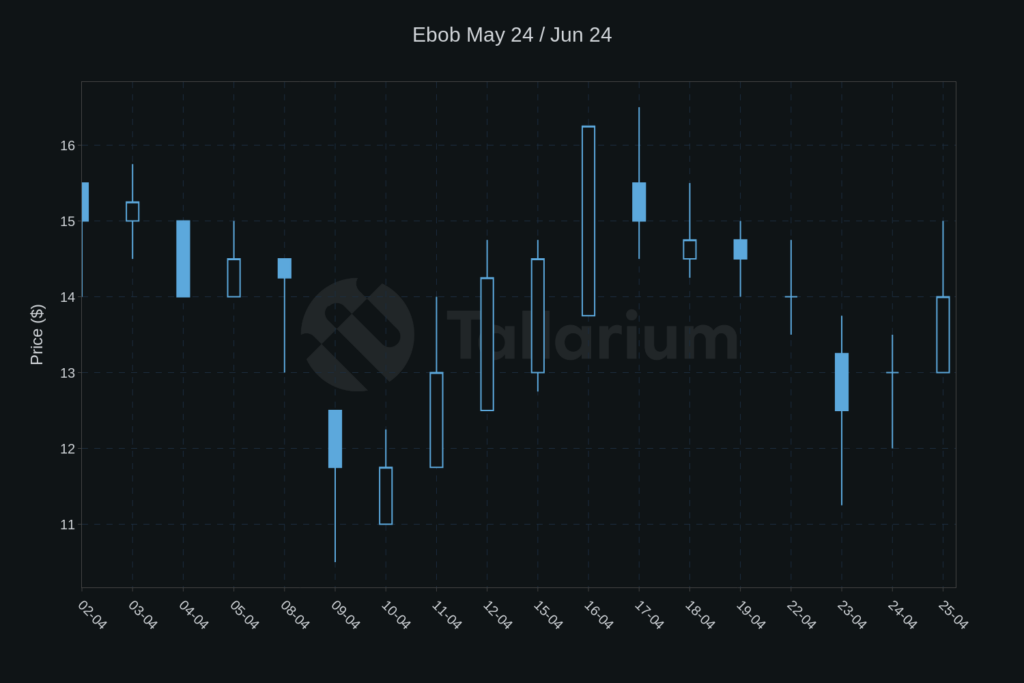

Gasoline remains the strongest part of the complex despite a wobble at the start of the month. May/Jun Ebob dipped to $10.75/MT and has since recovered to trade back into the mid-teens, while the May Ebob Crack is trading around $23/bbl. Gasoline traders have remarked on burgeoning gasoline stocks in Padd 3 as a potential source of weakness, but overall US stocks – in particular Padd1 where NYMEX RBOB prices – remain extremely low historically. Sparing a disappointing US driving season, Gasoline should remain strong over the summer and should retain its position as the clean product traders are backing to keep support margins, in light of recent Crude strength.

Distillates

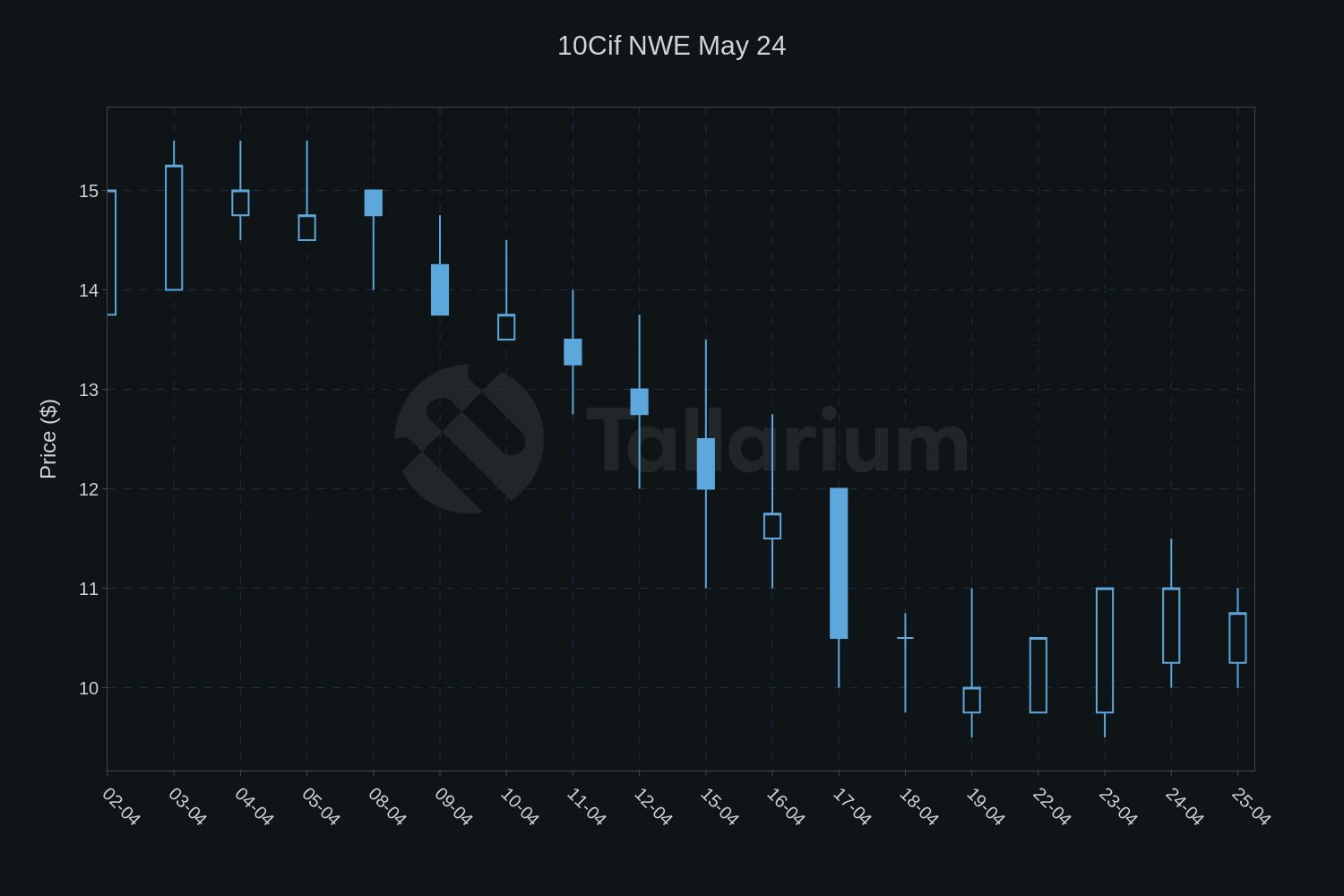

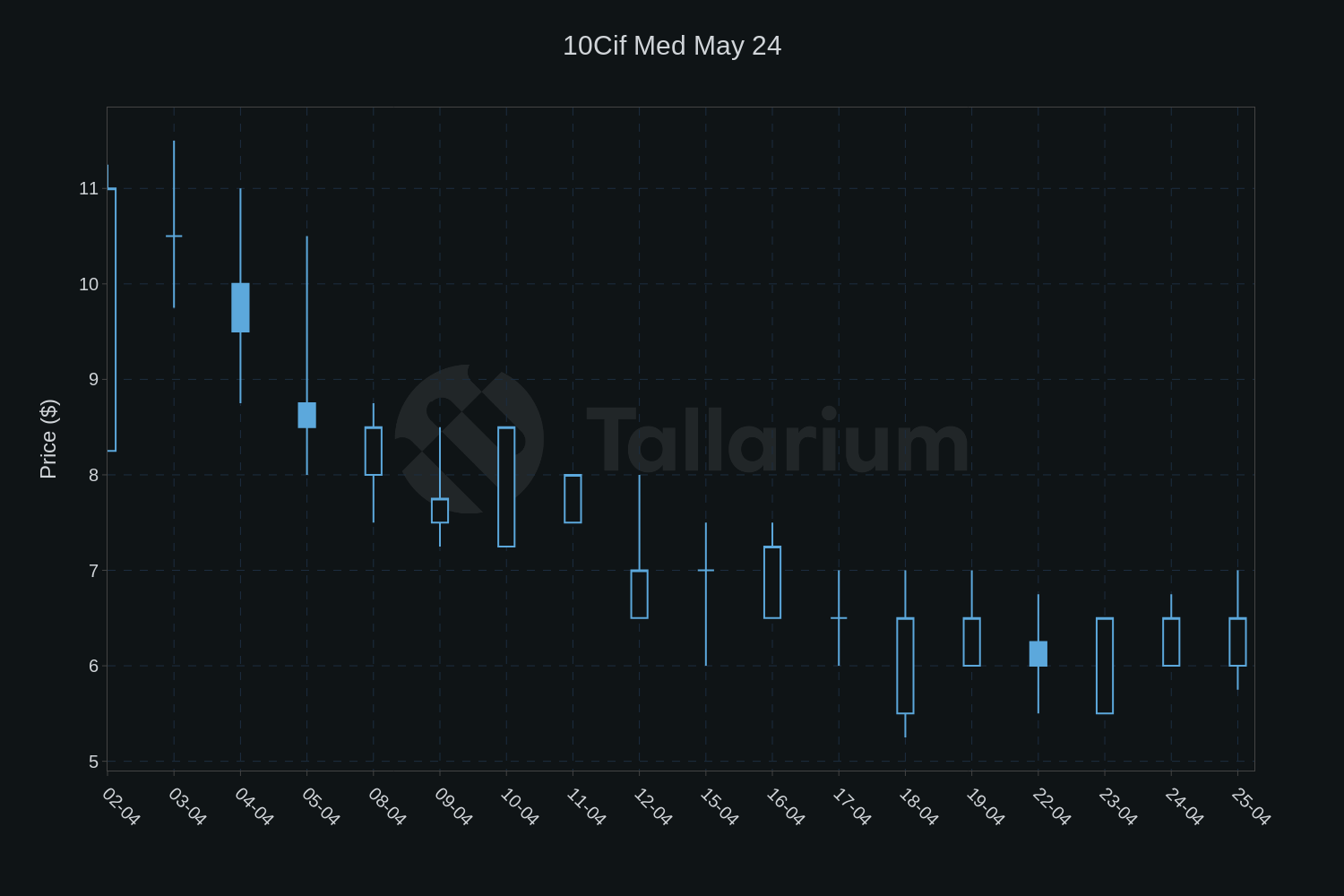

10ppm Diesel has had a steady decline throughout April. The key benchmark futures are all establishing a prompt contango: with May/Jun ICE Gasoil trading at -$2.50/MT, May/Jun HO at -100pts/GAL, and May/Jun Sing GO -$0.10/bbl. This was led by weaker cash markets in Asia and the resultant glut of cargoes which arrived into Europe via the Cape in April. The challenges with shipping Diesel to Europe via the Red Sea in Q1 have seemingly been circumvented a little too enthusiastically by traders pushing CIF markets into oversupply. The slump in NWE and Med CIF markets means we could yet see more cargoes discharge into ARA leading to further pressure on the ICE Gasoil contract but it’s likely a lot of this is priced into the current May/Jun GO contango.

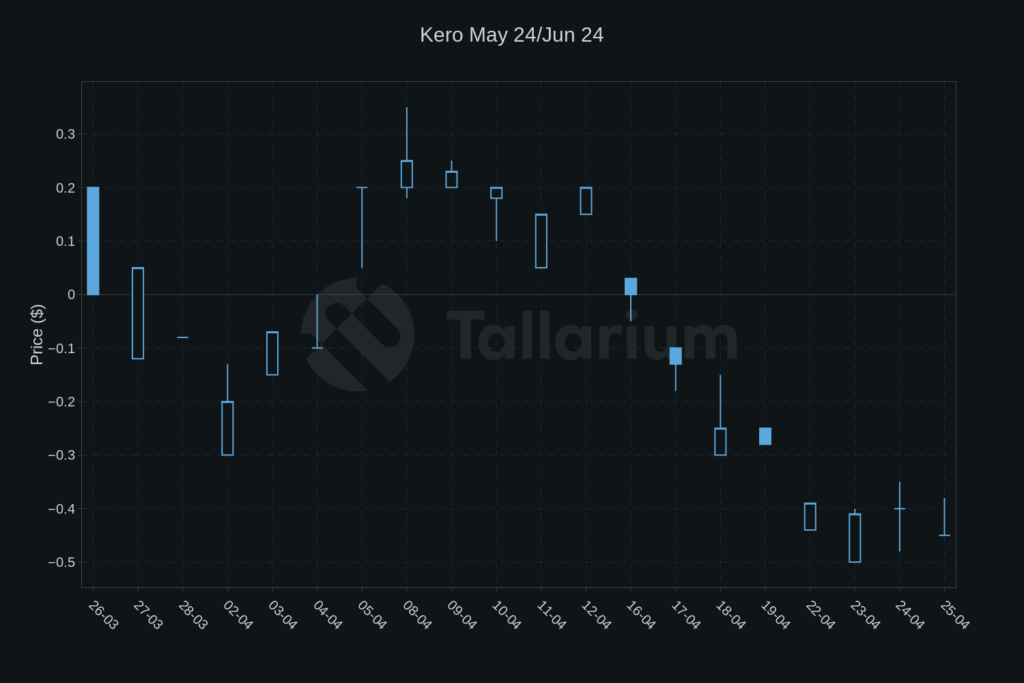

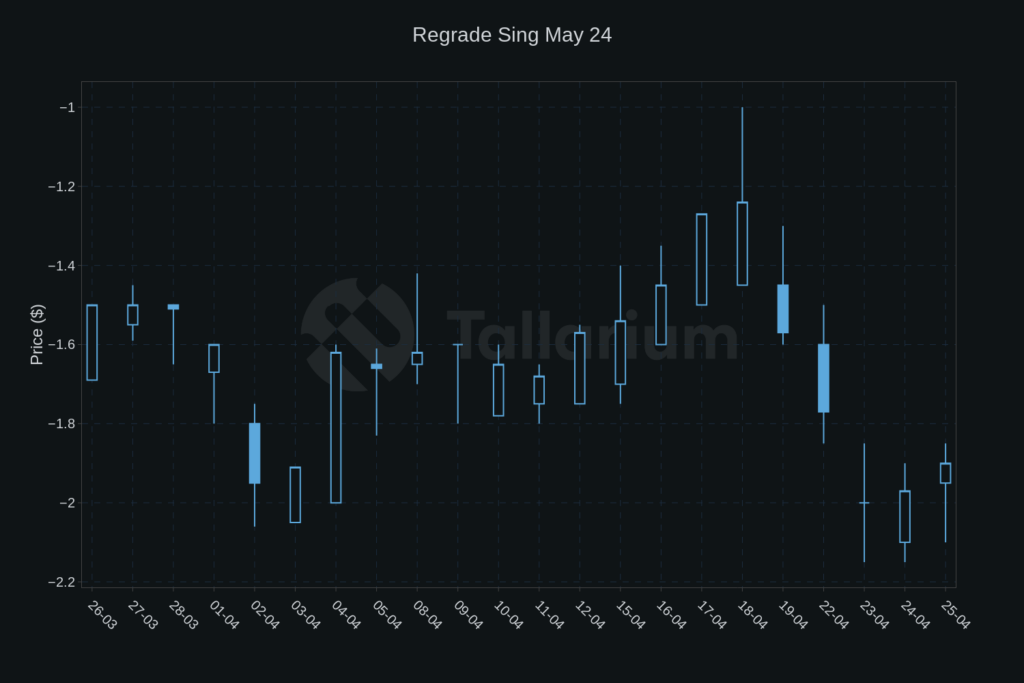

Jet has continued its precipitous decline, with Jet markets globally establishing a fully-fledged contango. The early-year fears that cargo diversions away from the Red Sea would lead to Europe struggling for re-supply have been shattered. The Jet/Diesel Regrade is now almost $2/bbl negative in Singapore and heading towards negative territory on a $/bbl basis in NWE. It will be key to watch refinery yields as this plays out, as the market may not be factoring in what “max Diesel, min Jet” would do to Diesel markets over the summer. The US numbers indicate US refiners can increase distillate production sharply over the coming months.