In moments like this, OTC markets provide a clearer view of oil fundamentals than flat price, which often gets muddled by the noise of speculative fast money. Crude oil started the month on a softer tone, with Brent flat price steadily drifting down into the mid-to-low $80s, from the heady heights of the mid $90s this time last month. This was a welcome correction in what looked like an overheated market.

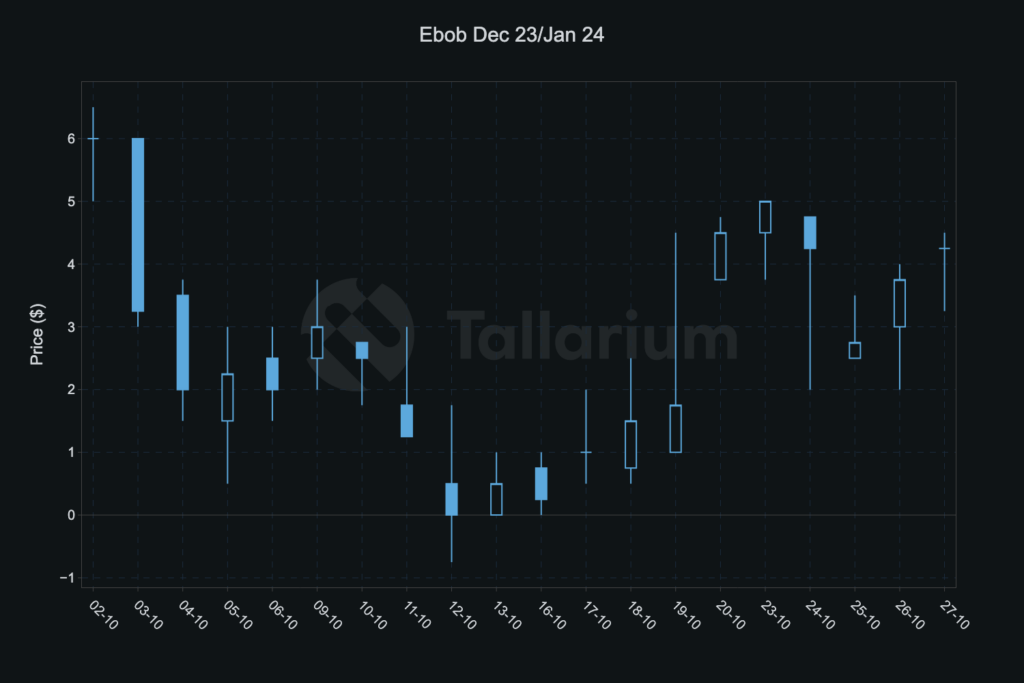

Mid-October saw a temporary boost in flat prices due to geopolitical tensions in the Middle East, but the month concluded with Brent flat prices once again dipping below $90. The mid-month price action in light ends was eye-catching. Dec/Jan EBOB briefly ventured into contango territory before bouncing back, and winter cracks have settled into low single figures. While gasoline is recovering, its earlier weakness was enough to rattle the oil complex bulls and has put pressure on margins in some regions, contributing to the weakness in crude spreads. With gasoline remaining somewhat vulnerable, the onus falls once again on distillates for the crude bulls to prevail.

Light Ends

Gasoline stocks in the US saw a grew sharply after the driving season, now standing at 15.6 million barrels (or 7.5%) higher YoY. While one could argue that this this provided confirmation for the steadily declining values observed in late September and early August, the subsequent rebound appears to be an overly optimistic case of “buy the rumour, sell the fact.” Anecdotal evidence suggests that wholesale gasoline weakness in Chicago and Group 3 is still pronounced enough to push refinery margins dangerously close to non-profitable levels. Whether this can be attributed to genuine demand destruction remains to be seen, but it’s a situation worth monitoring closely, as it will impact WTI time spreads.

Distillates

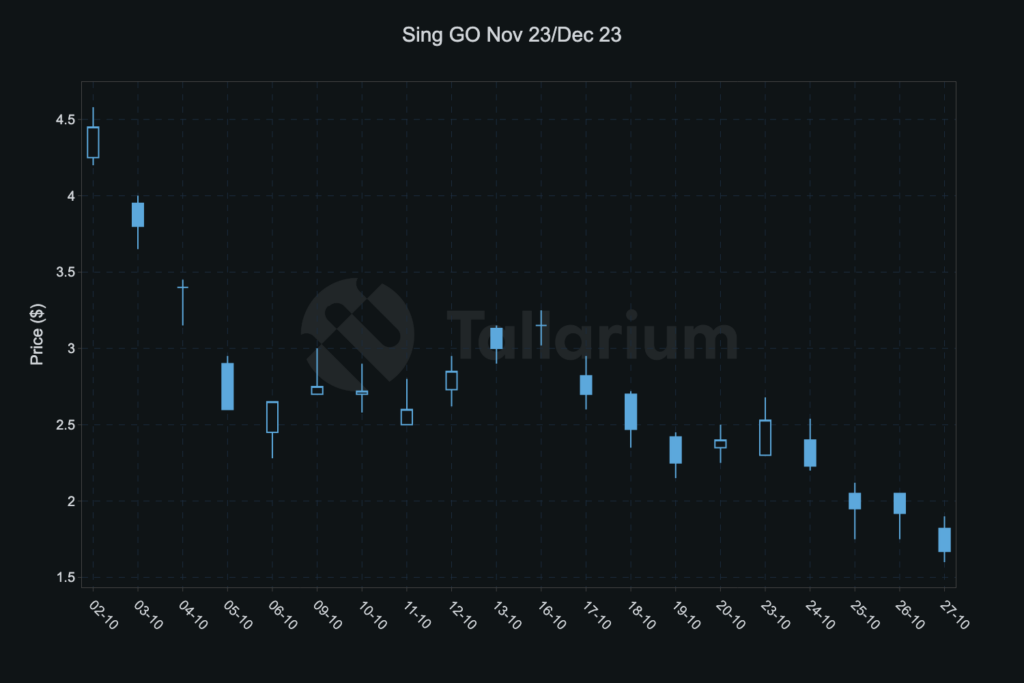

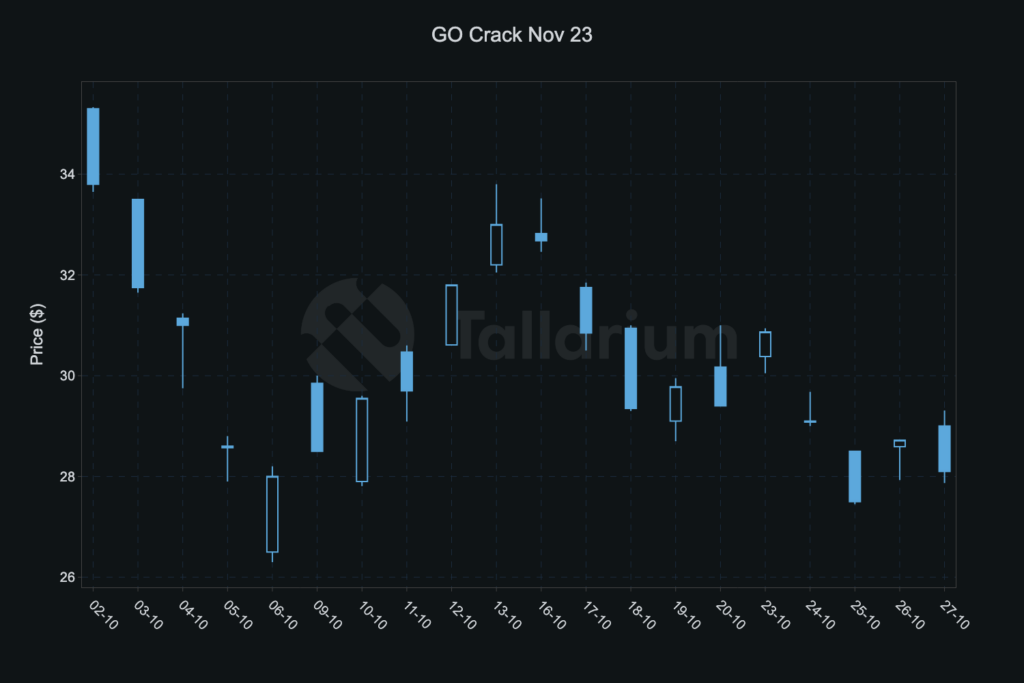

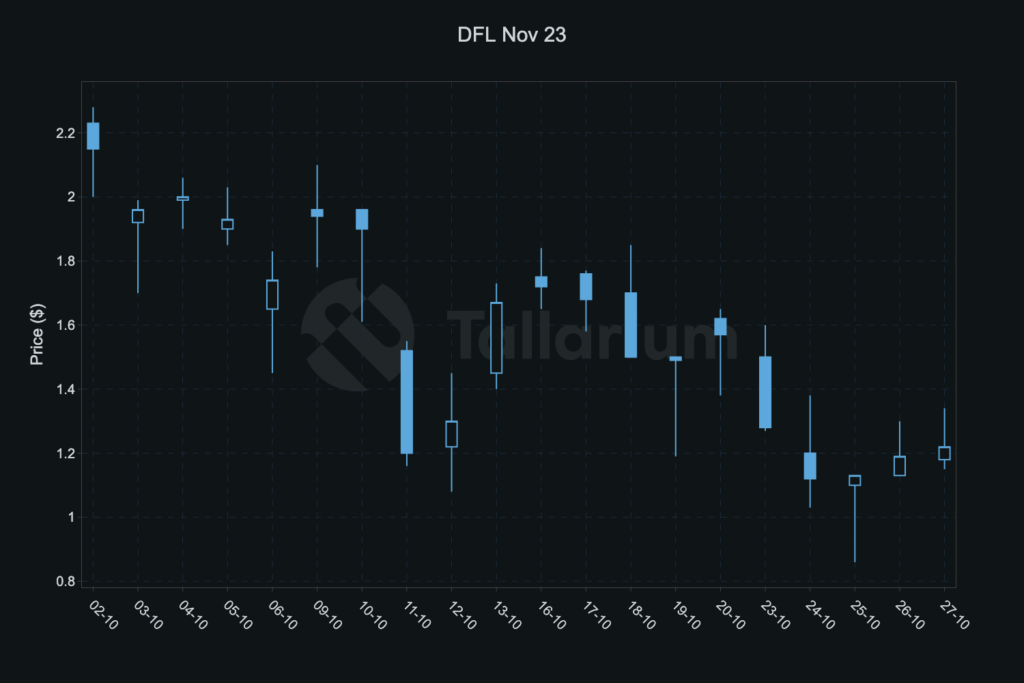

European distillate differentials are trading sideways to lower with the Med in particular an area of concern. Nov 10ppm CIF Med traded as low as $6/mt, a stark contrast from the mid-month highs in the mid-teens. This likely reflects the market digesting arbitrage cargos locked in while the East/West spread was at its weakest in September. While these differentials have likely stabilised now and will probably edge higher, the overall distillate price set no longer paints the extreme bull scenario we saw a month ago. GO cracks have been sideways and trading but at the lower end of their range, while Singapore and ICE gasoil time spreads have been consistently declining, as they seek to find the appropriate level of backwardation.