The first half of August saw strength across the entire oil complex. Brent made a push up

towards $90/bbl before easing in tandem with the recent weakness across global equities

(October Brent futures currently trading $83.98/bbl).

Macro players are rightfully concerned about a potential slowdown in Chinese economic activity; however, this is not showing up in the oil complex just yet. Most product markets remain very tight on stocks and consequently trading in steep backwardation with ascendant cracks. This month middle distillates have taken over the mantle from gasoline as the strongest part of the barrel, but that’s not to say gasoline has weakened.

European clean product cracks and spreads are at their year highs. Naphtha is also seemingly back from the abyss with cracks climbing up and spreads now firmly backward. At these levels, crude flat price and spreads once again look like the outlier and perhaps they need to appreciate to bring margins and product demand back into sustainable ranges.

Light Ends

Gasoline continues to punish bears with any weakness this summer being the pre-cursor for

new highs. Sep/Oct EBOB has recently traded above $90/MT to make new highs before we

enter September pricing. With the over-arching flat price environment remaining stable

there has been no evidence of demand erosion at the pump in Europe. This together with

the anaemic stock levels in ARA mean that any incremental demand just results in further

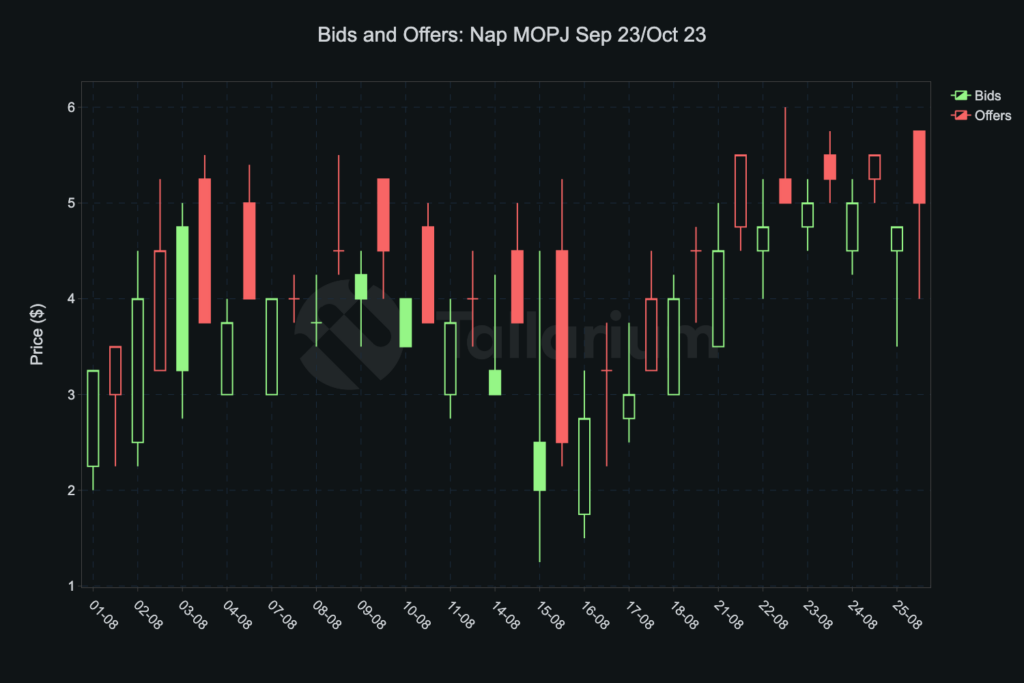

backwardation. Naphtha has notably turned a corner with a rebound in MOPJ values

seemingly pulling the complex out of the gutter. Nothing to get too excited about but at

these levels it’s no longer a weight on the complex.

Nap MOPJ Sep 23/ Oct 23

EBOB Sep 23 / Oct 23

Distillates

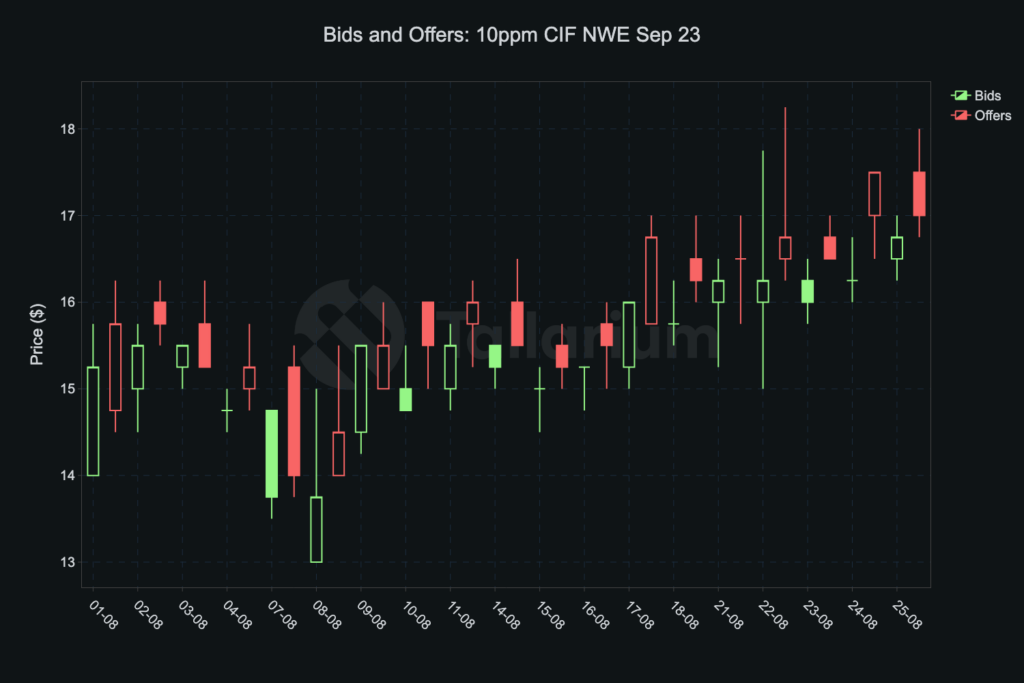

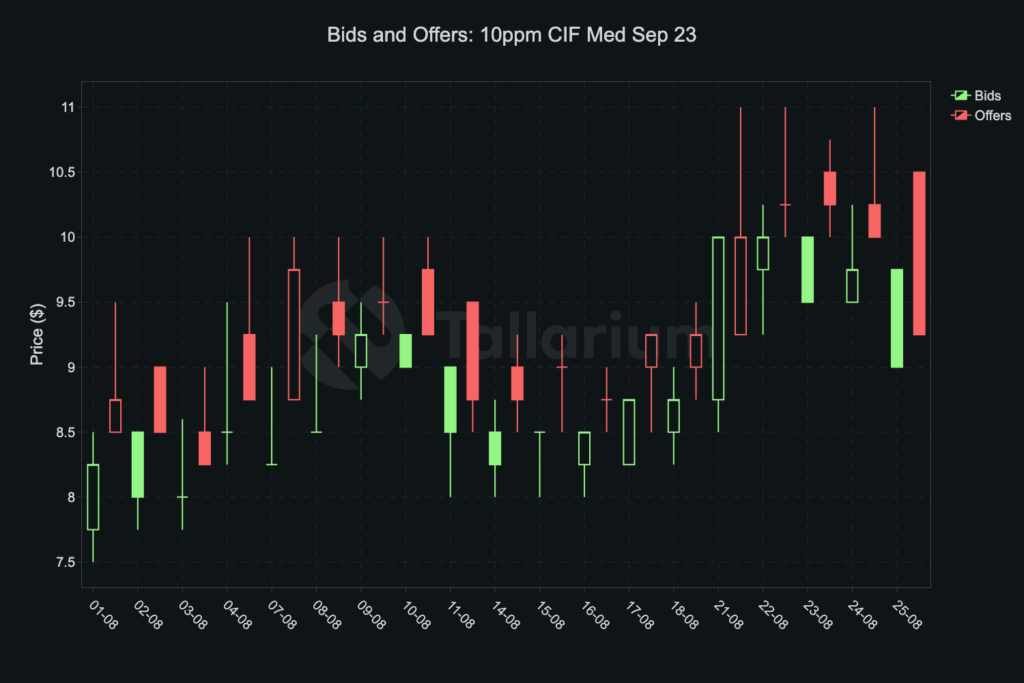

Distillate markets are ending the month extremely strong. The prompt gasoil crack is trading

c. $40/bbl, while Oct/Nov ICE Gasoil – the first winter spec spread on the screen – is trading at

$30/MT backwardation. 10ppm CIF NWE and Med differentials in Europe are comfortably in

double figures and have done a lot of work to attract re-supply. Looking at values now, it’s

hard to get a lot more bullish from this point as we are at levels from which the market has

tended to correct lower this year.

With freight relatively cheap this summer, physical traders will be busy seeing what can get packaged up from the East to send to Europe. This will not be easy however as Singapore time spreads indicate stocks are equally low in the East. The price action in Singapore needs to be watched closely as for values to soften in the Atlantic Basin, Asia will have to price lower first. If the Chinese slowdown is real, then increased product export quotas later in the year could be the solver to ease global distillate tightness.

10ppm CIF NWE Sep 23

10ppm CIF Med Sep23

Sing GO Sep23/Oct23